Change costs. Cost management and operational management decisions

Let's consider the variable costs of an enterprise, what they include, how they are calculated and determined in practice, consider methods for analyzing the variable costs of an enterprise, the effect of changing variable costs at different volumes of production and their economic meaning. In order to easily understand all this, an example of variable cost analysis based on the break-even point model is analyzed at the end.

Variable costs of the enterprise. Definition and their economic meaning

Variable costs of the enterprise (EnglishVariableCost,V.C.) are the costs of the enterprise/company, which vary depending on the volume of production/sales. All costs of an enterprise can be divided into two types: variable and fixed. Their main difference is that some change with increasing production volume, while others do not. If the company's production activities cease, then variable costs disappear and become equal to zero.

Variable costs include:

- The cost of raw materials, materials, fuel, electricity and other resources involved in production activities.

- Cost of manufactured products.

- Wages of working personnel (part of the salary depends on the standards met).

- Percentages on sales to sales managers and other bonuses. Interest paid to outsourcing companies.

- Taxes that have a tax base based on the size of sales and sales: excise taxes, VAT, unified tax on premiums, tax according to the simplified tax system.

What is the purpose of calculating the variable costs of an enterprise?

Behind any economic indicator, coefficient and concept one should see their economic meaning and the purpose of their use. If we talk about the economic goals of any enterprise/company, then there are only two of them: either increasing income or reducing costs. If we summarize these two goals into one indicator, we get the profitability/profitability of the enterprise. The higher the profitability/profitability of an enterprise, the greater its financial reliability, the greater the opportunity to attract additional borrowed capital, expand its production and technical capacities, increase intellectual capital, increase its value in the market and investment attractiveness.

The classification of enterprise costs into fixed and variable is used for management accounting, and not for accounting. As a result, there is no such item as “variable costs” in the balance sheet.

Determining the size of variable costs in the overall structure of all enterprise costs allows you to analyze and consider various management strategies for increasing the profitability of the enterprise.

Amendments to the definition of variable costs

When we introduced the definition of variable costs/costs, we were based on a model of linear dependence of variable costs and production volume. In practice, variable costs often do not always depend on the size of sales and output, so they are called conditionally variable (for example, the introduction of automation of part of the production functions and, as a result, a reduction in wages for the production rate of production personnel).

The situation is similar with fixed costs; in reality, they are also semi-fixed in nature and can change with production growth (increasing rent for production premises, changes in the number of personnel and a consequence of the volume of wages. You can read more about fixed costs in detail in my article: "".

Classification of enterprise variable costs

In order to better understand how to understand what variable costs are, consider the classification of variable costs according to various criteria:

Depending on the size of sales and production:

- Proportional costs. Elasticity coefficient =1. Variable costs increase in direct proportion to the growth of production volume. For example, production volume increased by 30% and costs also increased by 30%.

- Progressive costs (analogous to progressive-variable costs). Elasticity coefficient >1. Variable costs have a high sensitivity to change depending on the size of output. That is, variable costs increase relatively more with production volume. For example, production volume increased by 30%, and costs by 50%.

- Degressive costs (analogous to regressive-variable costs). Elasticity coefficient< 1. При увеличении роста производства переменные издержки предприятия уменьшаются. Данный эффект получил название – «эффект масштаба» или «эффект массового производства». Так, например, объем производства вырос на 30%, а при этом размер переменных издержек увеличился только на 15%.

The table shows an example of changes in production volume and the size of variable costs for their various types.

According to statistical indicators, there are:

- Total variable costs ( EnglishTotalVariableCost,TVC) – include the totality of all variable costs of the enterprise for the entire range of products.

- Average variable costs (AVC, AverageVariableCost) – average variable costs per unit of product or group of goods.

According to the method of financial accounting and attribution to the cost of manufactured products:

- Variable direct costs are costs that can be attributed to the cost of goods manufactured. Everything is simple here, these are the costs of materials, fuel, energy, wages, etc.

- Variable indirect costs are costs that depend on the volume of production and it is difficult to assess their contribution to the cost of production. For example, during the industrial separation of milk into skim milk and cream. Determining the amount of costs in the cost price of skim milk and cream is problematic.

In relation to the production process:

- Production variable costs - costs of raw materials, supplies, fuel, energy, wages of workers, etc.

- Non-production variable costs are costs not directly related to production: commercial and administrative expenses, for example: transportation costs, commission to an intermediary/agent.

Formula for calculating variable costs/expenses

As a result, you can write a formula for calculating variable costs:

Variable costs = Costs of raw materials + Materials + Electricity + Fuel + Bonus part of salary + Interest on sales to agents;

Variable costs= Marginal (gross) profit – Fixed costs;

The combination of variable and fixed costs and constants constitute the total costs of the enterprise.

Total costs= Fixed costs + Variable costs.

The figure shows the graphical relationship between enterprise costs.

How to reduce variable costs?

One strategy for reducing variable costs is to use “economies of scale.” With an increase in production volume and the transition from serial to mass production, economies of scale appear.

Economies of scale graph shows that as production volume increases, a turning point is reached when the relationship between costs and production volume becomes nonlinear.

At the same time, the rate of change in variable costs is lower than the growth of production/sales. Let's consider the reasons for the appearance of the “production scale effect”:

- Reducing management personnel costs.

- Use of R&D in production. An increase in output and sales leads to the possibility of carrying out expensive research work to improve production technology.

- Narrow product specialization. Focusing the entire production complex on a number of tasks can improve their quality and reduce the amount of defects.

- Production of products similar in the technological chain, additional capacity utilization.

Variable costs and break-even point. Example calculation in Excel

Let's consider the break-even point model and the role of variable costs. The figure below shows the relationship between changes in production volume and the size of variable, fixed and total costs. Variable costs are included in total costs and directly determine the break-even point. More

When the enterprise reaches a certain volume of production, an equilibrium point occurs at which the size of profits and losses coincides, net profit is equal to zero, and marginal profit is equal to fixed costs. Such a point is called break-even point, and it shows the minimum critical level of production at which the enterprise is profitable. In the figure and calculation table presented below, 8 units are achieved by producing and selling. products.

The enterprise's task is to create security zone and ensure a level of sales and production that would ensure the maximum distance from the break-even point. The further an enterprise is from the break-even point, the higher the level of its financial stability, competitiveness and profitability.

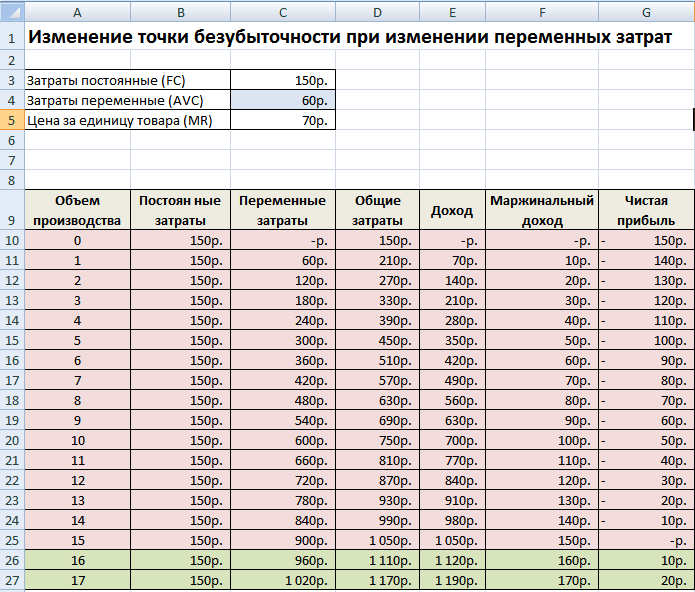

Let's look at an example of what happens to the break-even point when variable costs increase. The table below shows an example of changes in all indicators of income and costs of an enterprise.

As variable costs increase, the break-even point shifts. The figure below shows a graph for achieving the break-even point in a situation where the variable costs of producing one unit of steel are not 50 rubles, but 60 rubles. As we can see, the break-even point became equal to 16 units of sales/sales or 960 rubles. income.

This model, as a rule, operates with linear relationships between production volume and income/costs. In real practice, dependencies are often nonlinear. This arises due to the fact that production/sales volume is influenced by: technology, seasonality of demand, influence of competitors, macroeconomic indicators, taxes, subsidies, economies of scale, etc. To ensure the accuracy of the model, it should be used in the short term for products with stable demand (consumption).

Summary

In this article, we examined various aspects of variable costs/costs of an enterprise, what forms them, what types of them exist, how changes in variable costs and changes in the break-even point are related. Variable costs are the most important indicator of an enterprise in management accounting, for creating planned tasks for departments and managers to find ways to reduce their weight in total costs. To reduce variable costs, production specialization can be increased; expand the range of products using the same production facilities; increase the share of scientific and production developments to improve efficiency and quality of output.

6.1. Theoretical introduction

To ensure the financial stability of the enterprise, much attention is paid to cost management. Based on the type of dependence of the expense item on the volume of production, costs can be divided into two categories - permanent And variables. Variable expenses ( V.C.) depend on the volume of production (for example, raw materials, piecework wages, fuel and electricity for production machines). As a rule, variable costs increase in proportion to the increase in production volumes, i.e. the value of variable costs per unit of production (v) remains constant

where VC is the sum of variable costs,

Q – production volume.

Fixed expenses ( FC) do not depend on production volume (for example, staff salaries, accrued depreciation, etc.). This category also includes fixed costs, which, with a significant increase in production volumes, change in steps, i.e. expenses that can be classified as semi-fixed (for example, when output increases above a certain level, a new warehouse is required). Fixed costs per unit (f) decrease as production volume increases

Depending on the attribution of the cost item to a specific type of product, costs are divided into direct (related to the production of a specific type of product) and indirect (not related to the production of a specific product). The division of costs into direct and indirect is used when studying the impact of the release (or refusal to release) of a particular type of product on the amount and structure of costs. Practice shows that for most enterprises, direct and variable costs coincide to a first approximation. The accuracy of matching direct and variable costs in many cases is at least 5%. In a preliminary analysis that identifies the main cost components, this accuracy is sufficient.

Classification of costs into variable and constant is necessary to calculate the break-even point, profitability threshold and margin of financial safety.

Break even characterizes the critical volume of production in physical terms, and profitability threshold– in terms of value. Calculation of parameters is based on calculation of gross income

where GI is gross income;

S – sales in value terms;

P – product price.

The break-even point (Q without) is the volume of output at which gross income is zero. From equation (6.3)

. (6.4)

The profitability threshold (Sr) is the volume of sales revenue that reimburses production costs, but the profit is zero. The profitability threshold is calculated using the formula

The difference between sales in value terms and variable costs determines marginal income (MS)

![]() . (6.6)

. (6.6)

Marginal income per unit of production With equal to the additional gross income that the enterprise will receive as a result of the sale of an additional unit of production

![]() . (6.7)

. (6.7)

As can be seen from (6.6) and (6.7), marginal income does not depend on the level of semi-fixed expenses, but increases when variables are reduced.

The difference between sales revenue and the profitability threshold is financial safety margin(ZFP). FFP is the amount by which the volume of production and sales deviates from the critical volume. FFP can be characterized by relative and absolute indicators.

In absolute terms, the FFP is equal to

![]() , (6.8)

, (6.8)

In relative terms, the FFP is equal to

![]() (6.9)

(6.9)

Where Q– current output volume.

The FFP shows by what percentage the sales volume can be changed without falling into the loss zone. The greater the margin of financial strength, the less business risk.

A key characteristic in the cost management process is the level of additional costs associated with cost reduction items. Cost management comes down to identifying controllable items (for which adjustments are possible as a result of certain activities), determining the amount of cost reduction (in%) and one-time expenses for the relevant activities. Those activities for which the effectiveness indicator (e) is maximum are considered acceptable. .

![]() ,

(6.10)

,

(6.10)

where ΔGI is the relative change in gross income as a result of

cost reduction;

GI 0 – level of gross income before cost reduction;

GI 1 – level of gross income of cost reduction;

Z – one-time costs for reduction measures

Relationship between changes in profit and expenses:

![]() ,

(6.11)

,

(6.11)

Where Cx- some expense item,

Ref- all other expenses.

The following formula shows by what percentage gross income will change when expenses change Cx by 1%:

![]() .

(6.12)

.

(6.12)

Formula (6.12) is valid for a situation where the volume of revenue and the amount of other expenses are fixed.

Problem 1. The company produces the carbonated drink "Baikal". Variable costs per unit of production are 10 rubles, fixed costs are 15,000 rubles. Sale price 15 rub. What quantity of drink must be sold to obtain a gross income of 20,000 rubles.

Solution.

1. Determine marginal income (rub.) using formula (6.7):

2. Using (6.3), we determine the quantity of products (units) that must be sold to obtain GI in the amount of 20,000 rubles.

Task 2. The price of the product is 4 rubles. at the level of variable costs – 1 rub. The volume of fixed costs is 14 rubles. Production volume – 50 units. Determine the break-even point, profitability threshold and margin of financial strength.

Solution.

1. Determine the production volume at the break-even point:

![]() (units).

(units).

2. According to formula (4.5), the profitability threshold (RUB) is equal to:

![]()

3. The absolute value of the financial safety margin:

4. Relative value of the financial safety margin:

An enterprise can change its sales volume by 90% without incurring losses.

6.3. Tasks for independent work

Task 1. Variable costs for producing a unit of product are 5 rubles. Fixed monthly costs 1,000 rubles. Determine the break-even point and marginal profit at the break-even point if the price of the product on the market is 7 rubles. Determine the margin of financial safety at a volume of 700 units.

Problem 2. Sales revenue – 75,000 rubles, variable costs – 50,000 rubles. for the entire production volume, fixed costs amounted to 15,000 rubles, gross income - 10,000 rubles. The volume of production is 5,000 units. Unit price – 15 rubles. Find the break-even point and profitability threshold.

Task 3. The company sells products with a given demand curve. The cost per unit of production is 3 rubles.

|

Price, rub. |

|||||||

|

Demand, pcs. |

What will be the price and contribution margin, provided that the company's goal is to maximize profits from sales.

Task 4. The company produces two types of products. Determine the profit and marginal income from the main and additional orders. Fixed costs – 600 rub.

|

Indicators |

Product 1 |

Product 2 |

Add. order |

|

Unit price, rub. |

|||

|

Variable costs, rub. |

|||

|

Issue, pcs. |

Task 5. The aircraft factory's break-even point is 9 aircraft per year. The price of each aircraft is 80 million rubles. Marginal profit at the break-even point is RUB 360 million. Determine how much the aircraft factory spends per month on expenses not directly related to production?

Task 6. A skate seller conducts market research. The population of the city is 50 thousand people, age distribution:

For 30% of schoolchildren, parents are ready to purchase skates. The company decides to enter the market if the resulting marginal profit is sufficient to cover expenses in the amount of 45,000 rubles. with variable costs of 60 rubles. What should the price be to maximize contribution margin?

Task 7. The company expects to sell 1,300 sets of furniture. The costs for 1 set are 10,500 rubles, including variable costs of 9,000 rubles. Selling price 14,500 rub. How much volume must be sold to achieve break-even production? What is the volume that ensures a production profitability of 35%. What will be the profit if sales increase by 17%? What should the price of the set be in order to make a profit of 1 million rubles by selling 500 products?

Task 8. The operation of the enterprise is characterized by the following indicators: sales revenue 340 thousand rubles, variable expenses 190 thousand rubles, gross income 50 thousand rubles. The company is looking for ways to increase gross income. There are options for reducing variable costs by 1% (the cost of the event is 4 thousand rubles), or alternative measures to increase sales volume by 1% (one-time expenses in the amount of 5 thousand rubles). What activities should funds be allocated to first? Draw a conclusion based on the effectiveness of the measures.

Problem 9. As a result of the implementation of a comprehensive program at the enterprise, the cost structure has changed, namely:

The value of variable costs increased by 20%, while maintaining the value of constant costs at the same level;

15% of fixed costs were transferred to the category of variable, keeping the total amount of costs at the same level;

Total costs were reduced by 23%, including by 7% due to variables.

How did the changes affect the break-even point and the profit margin if the price was 18 rubles? Production volume and costs are given in the table.

|

Indicators |

Months |

|||

|

Production volume, pcs. |

||||

|

Production costs, rub. |

||||

Problem 10. The results of the analysis of the cost structure and opportunities for cost reduction are shown in the table.

Determine the final cost reduction (in %) and select from the proposed expense items the one you should pay attention to first.

| Previous |

Analysis of company performance indicators is an extremely important activity. This makes it possible to identify negative trends that hinder development and eliminate them. Cost formation is an important process on which the company’s net profit depends. In this matter, it is important to know what variable costs are and how they affect the performance of the enterprise. Their analysis applies certain formulas and approaches. You should learn more about how to find out the value of variable costs and how to interpret the results of the study.

general characteristics

Variable Costs (VC) are the costs of an organization that change in quantity according to the volume of production. If the company ceases to function, this indicator will be zero.

Variable costs include such types of costs as raw materials, fuel, energy resources for production. This also includes the salaries of key employees (the part that depends on the implementation of the plan) and sales managers (a percentage of sales).

This also includes tax levies, which are based on the amount of products sold. These are VAT, shares, tax according to the simplified tax system, unified tax, etc.

By calculating the variable costs of an enterprise, it is possible to increase the profitability of the company, provided that all factors influencing them are properly optimized.

Impact of sales volume

There are different types of variable costs. They differ in their defining characteristics and form certain groups. One of these classification principles is the breakdown of variable costs according to their sensitivity to the impact of sales volume on them. They come in the following types:

- Proportional costs. Their response coefficient to changes in production volume (elasticity) is equal to 1. That is, they grow in the same way as sales.

- Progressive costs. Their elasticity index is greater than 1. They increase faster than the volume of production. This is a high sensitivity to changes in conditions.

- Degressive costs respond to changes in sales volume more slowly. Their sensitivity to such changes is less than 1.

It is necessary to take into account the degree of response of changes in costs to an increase or decrease in production output when conducting an adequate analysis.

Other varieties

There are several other signs of classification of this type of costs. Statistically, an organization's variable costs can be general or average. The former include all variable costs for the full range of products, while the latter are determined per unit of product or a specific group of products.

Based on their attribution to cost, variable costs can be direct or indirect. In the first case, costs are directly included in the sales price of products. The second type of costs is difficult to estimate in order to attribute them to cost. For example, in the process of producing skim milk and cream, finding the cost of each of these items is quite problematic.

Variable costs can be manufacturing or non-manufacturing. The first includes the costs of raw materials, fuel, materials, wages and energy resources. Non-production variable costs should include administrative and commercial expenses.

Calculation

To calculate variable costs, a number of formulas are used. Their detailed study will allow us to understand the essence of the category under consideration. There are several approaches to analyzing the indicator. Variable costs, the formula for which is most often used in production, look like this:

PP = Materials + Raw materials + Fuel + Electricity + Salary bonus + Percentage for sales to sales representatives.

There is another approach to assessing the presented indicator. It looks like this:

PP = Gross (marginal) profit - fixed costs.

This formula emerges from the statement that the total costs of an enterprise are found by summing up fixed and variable costs. Using one of two approaches, you can assess the state of the indicator at the enterprise. However, if you want to evaluate the factors influencing the variable part of costs, it is better to use the first type of calculation.

Break even

Variable costs, the formula of which was presented above, play an important role in determining the break-even point of the organization.

At a certain equilibrium point, the enterprise produces such a volume of products at which the amount of profit and costs coincides. In this case, the company's net profit is 0. Marginal profit at this level corresponds to the amount of fixed costs. This is the break-even point.

It shows the minimum acceptable level of income at which the company's activities will be profitable. Based on such a study, the analytical service must determine a safe zone in which the minimum acceptable level of sales will be achieved. The higher the indicators from the break-even point, the greater the indicator of stability of the organization’s work and its investment rating.

How to apply calculations

When calculating variable costs, you should take into account the determination of the break-even point. This is due to a certain pattern. As variable costs increase, the break-even point shifts. At the same time, the profitability zone moves even higher on the chart. As production costs increase, a company must produce more products. And the cost of this product will also be higher.

Ideal calculations use linear relationships. But when conducting research in real production conditions, a nonlinear relationship may be observed.

For the model to work accurately, it must be applied in short-term planning and for stable product categories that are not dependent on demand.

Ways to reduce costs

To reduce variable costs, you can consider several ways to influence the situation. It is possible to take advantage of the effect of increasing production. With a significant increase in production volume, the change in variable costs becomes nonlinear. At a certain point, their growth slows down. This is the breaking point.

This happens for several reasons. Initially, management costs are reduced. With such events, it is possible to conduct scientific research and introduce technological innovations into the production process. The size of defects is reduced and product quality is improved. Fuller utilization of production capacity also has a positive effect on the indicator.

Having become familiar with the concept of variable costs, you can correctly use the methodology for calculating them in determining the development paths of the enterprise.

Each enterprise incurs certain costs in the course of its activities. There are different ones. One of them involves dividing costs into fixed and variable.

The concept of variable costs

Variable costs are those costs that are directly proportional to the volume of products and services produced. If an enterprise produces bakery products, then the consumption of flour, salt, and yeast can be cited as an example of variable costs for such an enterprise. These costs will increase in proportion to the increase in the volume of bakery products produced.

One cost item can relate to both variable and fixed costs. Thus, energy costs for industrial ovens on which bread is baked will serve as an example of variable costs. And the cost of electricity for lighting an industrial building is a fixed cost.

There is also such a thing as conditionally variable costs. They are related to production volumes, but to a certain extent. At a small production level, some costs still do not decrease. If a production furnace is half loaded, then the same amount of electricity is consumed as a full furnace. That is, in this case, when production decreases, costs do not decrease. But as output increases above a certain value, costs will increase.

Main types of variable costs

Here are examples of variable costs of an enterprise:

- The wages of workers, which depend on the volume of products they produce. For example, in a bakery production there is a baker and a packer, if they have piecework wages. This also includes bonuses and rewards to sales specialists for specific volumes of products sold.

- Cost of raw materials. In our example, these are flour, yeast, sugar, salt, raisins, eggs, etc., packaging materials, bags, boxes, labels.

- are the cost of fuel and electricity that is spent on the production process. It could be natural gas or gasoline. It all depends on the specifics of a particular production.

- Another typical example of variable costs are taxes paid based on production volumes. These are excise taxes, taxes under tax), simplified taxation system (Simplified taxation system).

- Another example of variable costs is paying for services from other companies if the volume of use of these services is related to the organization's level of production. These could be transport companies, intermediary firms.

Variable costs are divided into direct and indirect

This division exists because different variable costs are included in the cost of the product differently.

Direct costs are immediately included in the cost of the product.

Indirect costs are distributed over the entire volume of goods produced in accordance with a certain base.

Average variable costs

This indicator is calculated by dividing all variable costs by production volume. Average variable costs can either decrease or increase as production volumes increase.

Let's consider the example of average variable costs at a bakery enterprise. Variable costs for the month amounted to 4,600 rubles, 212 tons of products were produced. Thus, average variable costs will be 21.70 rubles/t.

Concept and structure of fixed costs

They cannot be reduced in a short period of time. If output volumes decrease or increase, these costs will not change.

Fixed production costs usually include the following:

- rent for premises, shops, warehouses;

- utility fees;

- administration salary;

- costs of fuel and energy resources, which are consumed not by production equipment, but by lighting, heating, transport, etc.;

- advertising expenses;

- payment of interest on bank loans;

- purchase of stationery, paper;

- costs of drinking water, tea, coffee for employees of the organization.

Gross costs

All of the above examples of fixed and variable costs add up to gross, that is, the total costs of the organization. As production volumes increase, gross costs increase in terms of variable costs.

All costs, in essence, represent payments for purchased resources - labor, materials, fuel, etc. The profitability indicator is calculated using the sum of fixed and variable costs. An example of calculating the profitability of core activities: divide profit by the amount of costs. Profitability shows the effectiveness of an organization. The higher the profitability, the better the organization performs. If profitability is below zero, then expenses exceed income, that is, the organization’s activities are ineffective.

Enterprise cost management

It is important to understand the essence of variable and fixed costs. With proper management of costs in an enterprise, their level can be reduced and greater profits can be obtained. It is almost impossible to reduce fixed costs, so effective work to reduce costs can be carried out in terms of variable costs.

How can you reduce costs in your enterprise?

Each organization works differently, but basically there are the following areas of cost reduction:

1. Reducing labor costs. It is necessary to consider the issue of optimizing the number of employees and tightening production standards. An employee can be laid off, and his responsibilities can be distributed among others, with additional payment for additional work. If production volumes increase at the enterprise and the need arises to hire additional people, then you can go by revising production standards and or increasing the volume of work in relation to old employees.

2. Raw materials are an important part of variable costs. Examples of their abbreviations could be as follows:

- searching for other suppliers or changing the terms of delivery by old suppliers;

- introduction of modern economical resource-saving processes, technologies, equipment;

- stopping the use of expensive raw materials or materials or replacing them with cheap analogues;

- carrying out joint purchases of raw materials with other buyers from one supplier;

- independent production of some components used in production.

3. Reduction of production costs.

This may include selecting other options for rental payments or subletting space.

This also includes savings on utility bills, which requires careful use of electricity, water, and heat.

Savings on repairs and maintenance of equipment, vehicles, premises, buildings. It is necessary to consider whether it is possible to postpone repairs or maintenance, whether it is possible to find new contractors for these purposes, or whether it is cheaper to do it yourself.

It is also necessary to pay attention to the fact that it may be more profitable and economical to narrow production and transfer some side functions to another manufacturer. Or, on the contrary, enlarge production and carry out some functions independently, refusing to cooperate with related companies.

Other areas of cost reduction may be the organization’s transport, advertising activities, reducing the tax burden, and paying off debts.

Any enterprise must take into account its costs. Work to reduce them will bring more profit and increase the efficiency of the organization.

Types of variable costs

- Regional

- Regressive

- Flexible

Variable Cost Examples

In accordance with IFRS standards, there are two groups of variable costs: production variable direct costs and production variable indirect costs. Manufacturing variable direct costs- these are costs that can be attributed directly to the cost of specific products based on primary accounting data. Manufacturing Variable Indirect Costs- these are costs that are directly dependent or almost directly dependent on changes in the volume of activity, however, due to the technological features of production, they cannot or are not economically feasible to be directly attributed to the manufactured products.

Examples of variable direct costs are:

- Costs of raw materials and basic materials;

- Energy costs, fuel;

- Wages of workers producing products, with accruals for it.

Examples of variable indirect costs are the cost of raw materials in complex industries. For example, when processing raw materials - coal - coke, gas, benzene, coal tar, and ammonia are produced. When milk is separated, skim milk and cream are obtained. It is possible to divide the costs of raw materials by type of product in these examples only indirectly.

Dependence of the type of costs on the cost object

The concept of direct and indirect costs is relative.

For example, if the main business is transportation services, then driver wages and vehicle depreciation will be direct costs, while for other types of business, vehicle maintenance and driver wages will be indirect costs.

If the cost object is a warehouse, then the warehouseman's wages will be a direct cost, and if the cost object is the cost of manufactured and sold products, then these costs (storekeeper's wages) will be indirect due to the impossibility of unambiguously and the only way to attribute it to the cost object - cost. Depending on the volume of products produced, the cost per unit of production will change with the only battery in this system

Properties of direct costs

- Direct costs increase in direct proportion to the volume of production and are described by the equation of a linear function in which b=0. If costs are direct, then in the absence of production they should be equal to zero, the function should begin at the point 0 . In financial models it is allowed to use the coefficient b to reflect the minimum wage of workers due to downtime due to the fault of the enterprise, etc.

- A linear relationship exists only for a certain range of values. For example, if, with an increase in production volumes, a night shift is introduced, then the pay for the night shift is higher than for the day shift.

Direct and variable costs in legislation

The concept of direct and variable costs is present in paragraph 1 of Article 318 of the Tax Code of the Russian Federation. These are called direct and indirect costs. According to tax legislation, direct expenses include, in particular:

- expenses for the purchase of raw materials, materials, components, semi-finished products;

- remuneration of production personnel;

- depreciation on fixed assets.

An enterprise may include in direct costs other types of costs directly related to the production of products. Direct expenses are taken into account when determining the tax base for income tax as products are sold, and indirect expenses - as they are realized.

see also

Notes

Wikimedia Foundation.

2010.

See what “Variable costs” are in other dictionaries: Cash and opportunity costs that change in response to changes in the volume of output. Typically, variable costs include wages, fuel, materials, etc. There are proportional variables, regressive... ...

Financial Dictionary variable costs

- Operating costs that change directly and proportionally with changes in production or sales volume, capacity utilization, or other performance metrics. Examples are materials consumed, direct labor,... ... VARIABLE COSTS - – any costs that change in direct proportion to changes in the level of production. They represent the costs associated with the use of a variable resource: raw materials, labor, etc...

Economics from A to Z: Thematic Guide Enterprise costs proportional to the volume of activity of the enterprise (costs of raw materials, direct labor costs, etc.) ...

Glossary of crisis management terms Variable costs (costs) - (Variable costs, VC) - costs, the value of which varies depending on changes in production volume: costs of raw materials, fuel, energy, wages, etc...

Economic and mathematical dictionary variable costs (costs) - Costs, the value of which changes depending on changes in production volume: costs of raw materials, fuel, energy, wages, etc.

Topics economics EN variable costsvc … Technical Translator's Guide - Costs, the value of which changes depending on changes in production volume: costs of raw materials, fuel, energy, wages, etc.

variable costs of producing (electrical or thermal) energy- - [A.S. Goldberg. English-Russian energy dictionary. 2006] Topics: energy in general EN variable energy costVEC ... - Costs, the value of which changes depending on changes in production volume: costs of raw materials, fuel, energy, wages, etc.

variable costs for the production of electrical or thermal energy- - [A.S. Goldberg. English-Russian energy dictionary. 2006] Topics: energy in general EN variable energy cost ... - Costs, the value of which changes depending on changes in production volume: costs of raw materials, fuel, energy, wages, etc.